Source: Clyde & Co LLP

In the second of the two-part insight exploring escalating trade tensions in Mexico, the newly imposed U.S. tariffs tied to immigration and drug enforcement concerns are considered, highlighting the economic risks for Mexico’s export-driven economy.

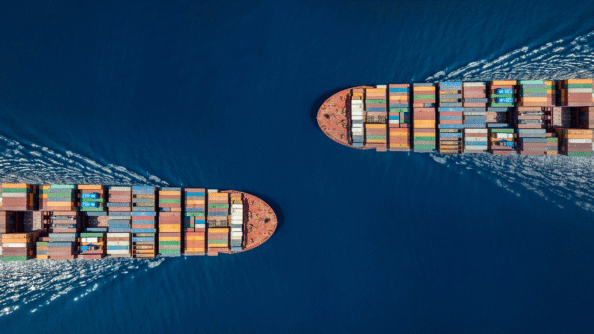

As one of Latin America’s largest economies and a key trade partner for numerous countries, Mexico is deeply embedded in the global trade system. Like many other countries, in recent months Mexico has found itself at the center of various trade disputes.

While the United States (US) may have dominated headlines, tension with neighboring Latin American countries like Ecuador have also come to the surface.

These pressures stem from a complex mix of political, economic, and strategic factors, each of which threatens to disrupt Mexico’s vital export-driven economy while also presenting substantial challenges for the country.

U.S.–Mexico Trade Conflict and Tariff Measures

Historically, the U.S. has been Mexico’s largest trading partner; the two nations exchanging billions of dollars in goods annually (approx. $800B in 2024), primarily under the United States-Mexico-Canada Agreement (USMCA), which replaced the North American Free Trade Agreement (NAFTA) in July 2020. Last year, Mexico became the U.S.’s largest supplier of goods, accounting for 15.6% of total U.S. imports from January to November 2024.

As noted in part one of this insight, an additional 25% ad valorem tariff was imposed on Mexican and Canadian products imported into the U.S. that were not USCMA compliant. Additionally, the U.S. also imposed a 25% ad valorem tariff to Mexican steel, aluminum, and related products. This move aims to combat illegal immigration and the smuggling of opioids, including fentanyl.

Despite the uncertain start to 2025 and the additional tariffs imposed, Mexican exportations were not affected during the first trimester of 2025, and Mexico remained the US’ top commercial partner.

Underlying Issues and Economic Risks

Although trade between the U.S. and Mexico remains steady, the motivations behind these measures stem from broader political and security concerns rather than economic impact. One significant source of tension involves labour conditions, rules of origin, and environmental standards in Mexico. The U.S. has criticized Mexico for not fully enforcing labour reforms outlined in the USMCA, which are designed to improve working conditions and wages in Mexican factories, particularly in the automotive and manufacturing sectors. Additionally, the U.S. administration has claimed that some vehicles sold to American consumers are unfairly benefiting from cheaper labour and lower tariffs due to the inclusion of non-U.S. sourced parts.

According to Trump’s February 1, 2025 Executive Order, the U.S. imposed additional tariffs on Mexico due to: (i) Mexico’s role in the ongoing influx of illicit opioids and other drugs that have caused a U.S. public health crisis, and (ii) the unimpeded transit of immigrants from Central and South America through Mexico into the U.S.

Although Mexican exports to the U.S. during this first trimester appear unaffected, the 25% U.S. tariff may severely impact Mexico’s economy during the 2025’s second trimester. The automotive sector, for instance, is one of Mexico’s largest export industries. A tariff on cars and auto parts could lead to a dramatic reduction in exports, costing Mexico billions of dollars. Additionally, these tariffs could strain the bilateral trade relationship, prompting retaliatory tariffs from Mexico and disrupting production and supply chains across North America (the likes we have seen from China). The broader implications for Mexico’s economy are also significant: a downturn in trade with the U.S. could lead to a drop in GDP growth, increased unemployment in manufacturing sectors, and pressure on the Mexican peso.

Mexico’s Legal Options and Diplomatic Strategy

There are some commentators who believe U.S. tariffs may violate Chapter 2 of the USMCA, and that Mexico could initiate a dispute resolution process either under the USMCA or at the World Trade Organization (WTO). Historically, the Mexican government has refrained from pursuing such procedures, as they are time-consuming and can harm amicable relations with the involved countries. Nevertheless, Mexican President Claudia Sheinbaum has declared that while Mexico will fight to maintain the USCMA trade agreement, it has already developed a contingency plan in case the U.S. refuses to maintain the 3 decade-long commercial agreement (previously NAFTA).

Conclusion

History seems to indicate that tariff barriers are not the most effective solution to address the underlying issues affecting these countries. Such measures could have adverse economic effects, especially on Mexico, whose exports are heavily reliant on the U.S. market.

As a result, Mexican companies must carefully evaluate the legal implications of tariff and non-tariff barriers that may affect their operations. They should also explore new markets and business opportunities to mitigate potential negative impacts on their business.

Symbiosis focuses its efforts in terms of export promotion, assistance with direct investment, and internationalization of Canadian companies. With deep cultural and business ties with the region and an understanding of the challenges presented to Canadian clients doing business in Mexico. Our team is positioned to timely and efficiently assist clients in providing counsel and the legal tools to assist in their positioning in Mexico. For further information, please contact us or book a call/video conference with a member of our team, it would be our pleasure to meet you and talk about your project.