THE NEW CREDIT ACCOUNTS AND GUARANTEES CONTROL SYSTEM

Due changes published at the beginning of 2014, a large number of enterprises requested their certification in terms of VAT (and IEPS when applicable) to the government. Starting 2015 every temporary import will generate VAT; certified companies may have a credit for payment of these taxes.

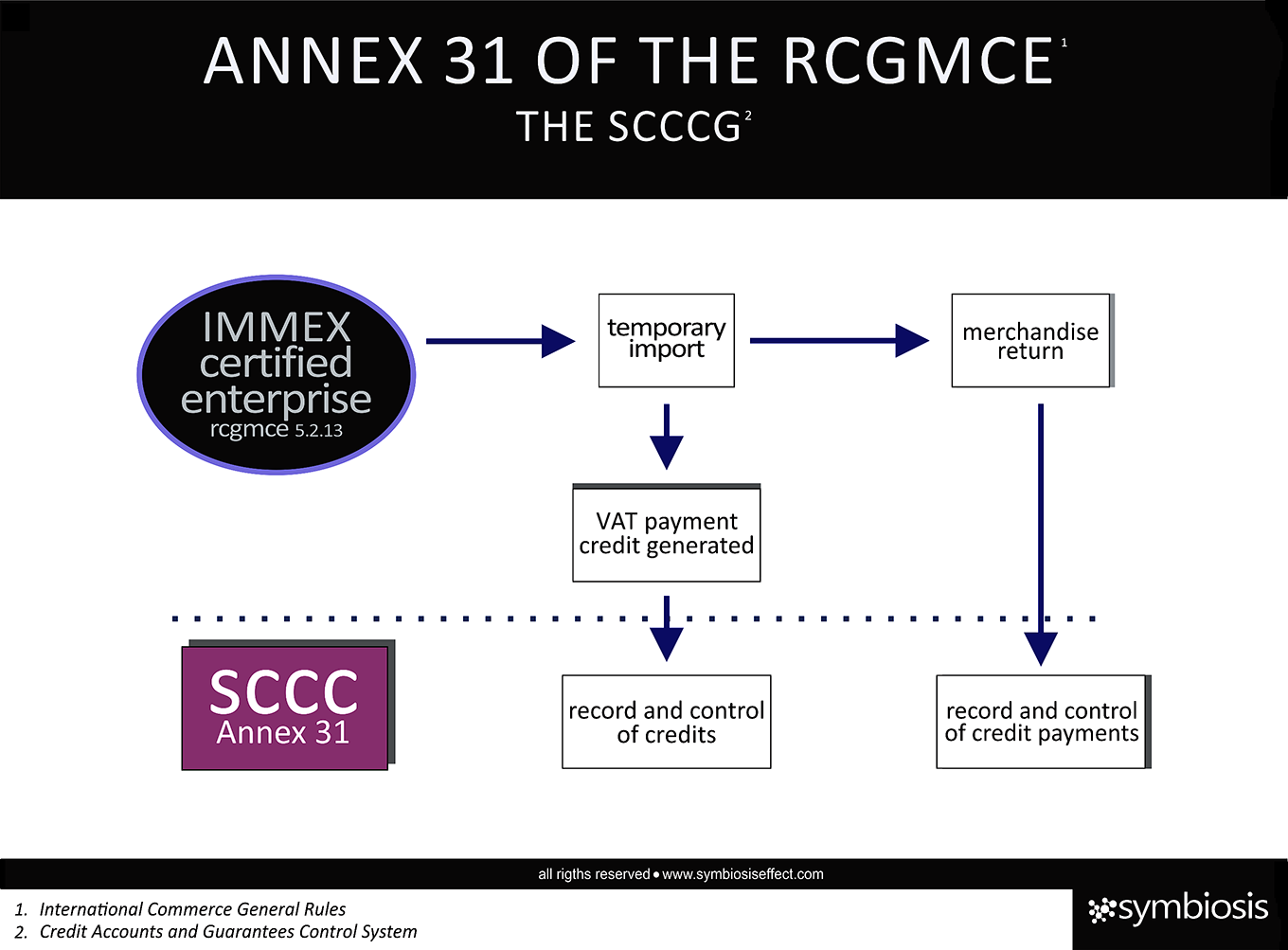

Many wondered how the authority would control the VAT credit for certified companies; the answer is the new Credit Accounts and Guarantees Control System (SCCCG from Spanish) which will take effect in January 2015.

The SCCC is basically a control system that the enterprise will use, at the time of temporary importation, to generate a VAT charge, this will be taken by authorities as a credit granted, each temporary importation will accumulate more VAT, the SCCC will keep a record on the amount that the company owes. When the enterprise made their returns abroad, the corresponding VAT amount will be diminished from the debt.

This a graphic shows the functioning of the system:

By December 31, 2014 certified companies should have ready an inventory (physical) showing all the consumables, machinery and equipment under the temporary importation program subject to the benefit of certification. This “initial inventory” should be presented to the authorities at the beginning of 2015, for a sole occasion, meaning there will be no possible modification or adjustments after this.

Temporary importation operations IN, V1 and any other applying VAT credit are going to be extracted directly from the SAAI, where the taxpayer shall declare the credit as a form of payment.

Certified enterprises should start sending monthly reports to the authorities showing the VAT credited and paid to keep a record on the SCCCG.

For further information and evaluation of your enterprise needs, please contact us.

This document contains general and public information, may be based on authorities that are subject to change, and is not a substitute for professional advice or services. This document does not constitute assurance, tax, consulting, business, financial, investment, legal or other professional advice, and you should consult a qualified professional advisor before taking any action based on the information herein. Symbiosis Effect, its affiliates and related entities are not responsible for any loss resulting from or relating to reliance on this document by any person.